Should you buy SAVA stock?

Buying shares of early stage biotech companies is one of the ways that cash-strapped investors can plant the seeds of massive growth. These companies have the potential to be 100x or 1000x the initial investment.

What better way than to look into a cure for Alzheimer’s? I got into SAVA (Cassava Biosciences, lead drug simufilam) at $47 when I was reading an article on Seeking Alpha about the promising company. Given my background treating Alzheimer’s patients, I knew I could do my own homework on the data. They have groundbreaking 9 month data on their new Alzheimer's drug, far better than any drug before it. At 9 months, instead of a 4 point decline as is typical in disease progression, it's a 3 point improvement. This 7 point difference is a very big deal for both cognition and ability to live independently. If even results half this good are replicated in a Phase 3 trial, the FDA would approve it easily. For me, seeing the data, the stock is already de-risked.

The stock is climbing fast, but it's still only a $3 billion company close to solving a $1 trillion dollar problem. If treatment costs $26k per year, and the disease kills 1 in 3 seniors around the world, the potential market for the drug is just huge. It’s around $96 today, already up 30x in past year, should go to $12000 if we value the company eventually hitting $400 billion in market cap. Be prepared for a lot of volatility.

As choppy as this stock SAVA has been, it's been staying above its 200 day moving average ever since good data has been first released, indicating that the recent dip is just profit taking after a massive 3000% run in past one year. It's currently oversold and looks like it's moving right back to its recent highs in the 130s. If it continues and makes new highs then it's very bullish. Also note that the stock is going up on increasing volume, another bullish indicator.

As far as high risk, high reward stocks go, I much prefer SAVA over stocks like ASTS, where the company keeps all their relevant technology details secret.

Here is a recent article I saw on this stock:

Cassava Sciences CEO Remi Barbier

By Paul Thompson – Assistant Managing Editor, Austin Business Journal

Austin-based pharmaceutical maker Cassava Sciences Inc. has spent much of 2021 as a Wall Street darling, thanks to a promising Alzheimer's disease treatment. Now the company is entering a new phase of growth, as it advances its research closer to putting a drug on the market.

It has vied with meme stocks such as AMC Holdings Inc. (NYSE: AMC) and GameStop Corp. (NYSE: GME) as one of the top-performing U.S. stocks of the year. Despite some recent volatility, the share price of Cassava (Nasdaq: SAVA) closed Aug. 5 at $101.59. That was up 1,390% from the start of the year — the No. 2 performance on the Russell 3000 Index, which tracks the 3,000 largest public companies in the country, according to Barchart.com, only trailing AMC.

Cassava's biggest hurdle is up next: a crucial third phase of clinical trials that could set the stage for the drug's approval by the Food and Drug Administration — or lead to a setback in the company's comeback story. It has a sizable war chest and a new headquarters as it embarks on this critical phase.

Cassava announced July 29 preliminary results from phase two trials for its Alzheimer's drug simufilam, during the Alzheimer's Association International Conference. The data showed simufilam could lead to an increase in cognition in patients with Alzheimer's disease, although experts point out the true test will be whether those results can be replicated in a phase three, randomized control study.

“We’re both humbled and energized by last week’s clinical data," Cassava CEO Remi Barbier said Aug. 4. “We believe the data will replicate in phase three.”

Cassava has about 25 employees and, as it revealed in an Aug. 3 securities filing, $278.3 million in cash on hand to support the next phase of clinical trials. Barbier has told investors the company may need to double its headcount every year "for a number of years."

The company on Aug. 4 completed the purchase of a two-building office complex in Austin comprising 90,000 square feet that will serve as its new corporate HQ, according to a securities filing. Cassava paid $21.9 million but did not disclose the site of the office.

That would be about 10 times larger than Cassava's current office space.

“We believe Cassava Sciences is headed for a period of hyper growth over the next few quarters and the next few years," Eric Schoen, Cassava's chief financial officer, said in an Aug. 3 earnings call.

Market reaction

Cassava's growth is driven by simufilam, a twice-daily pill the company sees as a potential game-changer in the fight against a devastating neurodegenerative disease that has seen relatively scant advances in treatment options in the past quarter of a century.

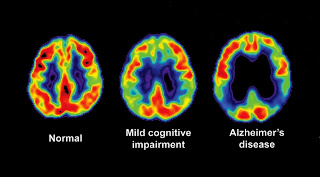

The industry standard to measure cognitive decline in Alzheimer's patients is called the Alzheimer’s Disease Assessment Scale-Cognitive Subscale, or ADAS-Cog. Patients typically see a little more than five points of cognitive decline in an ADAS-Cog test in a given year, Barbier said. But after a group of 50 subjects used simufilam for nine months, 66% actually saw cognitive improvement, according to the preliminary data from Cassava's phase two trials.

“Over nine months we would have expected to see four points of decline. Instead, we saw three points of improvement," Barbier said. “I’m not saying its evidence of efficacy. I’m saying it's very suggestive of treatment benefits.”

Despite the positive data, investors reacted to the July 29 AAIC announcement by selling off shares of Cassava's stock. The company's share price, which had closed July 28 at $135.30, closed July 30 at $69.53.

“One the one hand, the stock has tripled in the past two or three months. That’s not normal for any stock," Barbier said. "So there was quite a bit of profit taking."

On the other hand, Barbier said, there has been "renewed enthusiasm from Wall Street analysts" around Cassava's long-term prospects. Five analysts had a median price target of $145 for the stock, with a high of $215 and a low estimate of $109, according to CNN Business.

Barbier contends that his optimism for simufilam is driven entirely by the science and data.

“We may actually be fixing some of the neurological circuits in the brain. It’s very, very exciting," Barbier said. "The results are very promising; obviously they need to be replicated in a phase 3 program."

Next phase of R&D

Phase three trials represent the next hurdle for Cassava. Marc Engelsgjerd, a senior equity research analyst at Bloomberg who specializes in the biotech sector, said Barbier is right to be excited about the prospects for simufilam — provided the company's results can be replicated in a wider clinical trial.

“[Barbier's] not wrong in that if you can develop a small molecule pill for Alzheimer’s disease that can be definitively proven to improve cognition, that would very likely become one of the most successful products in pharmaceutical history," Engelsgjerd said. "But that’s a big if.”

Engelsgjerd added that he wasn't surprised to see the company's share price dip after its July 29 announcement, as it is common for investors to "sell the news" even when positive indicators emerge, typically out of a desire to take a profit.

“It clearly was not well received just based on the share price," Engelsgjerd said. "My take is that it is hypothesis-generating data. It’s intriguing data, but we really need to see a randomized, placebo-controlled trial to be able to say that this drug actually works.”

He added: “It’s hard to make definitive conclusions in any drug development program based on open label, uncontrolled data. For them, it’s going to come down to this phase three randomized study, as it should.”

Alberto Espay, a professor of neurology at the University of Cincinnati, said the preliminary data from Cassava could "represent an overestimation of the magnitude of benefit" even with positive biomarker changes in patients taking simufilam. Biomarkers are measurable substances in the body.

"The biomarker changes are certainly the most objective change," Espay said. "The extent to which these promising biomarker changes are associated with cognitive improvement and slowness in disease progression will require a blinded randomized controlled trial."

Cassava Sciences plans to initiate phase 3 trials this fall for simufilam, with "two double-blind, randomized, placebo-controlled studies in patients with mild-to-moderate Alzheimer's disease," according to a June 21 announcement.

"The data compared positively with other Alzheimer’s drug candidates, but most failed phase three trials came on the heels of very promising phase two trials — and even better open-label outcomes," Espay cautioned

Last drug

Cassava's history shows that public fanfare and investor enthusiasm don't always translate to regulatory success.

When it was known as Pain Therapeutics, the company developed a time-released alternative to Oxycontin that got to the brink of approval from the FDA. The company spent more than a decade and $150 million developing the drug, called Remoxy, before it was rejected by the FDA. The agency found that Remoxy data "do not support the conclusion" that its benefits outweighed its risks.

To this day Barbier believes in the efficacy of Remoxy, which he described as a painkiller that “you really could not abuse.”

He added: "Remoxy was really a clinical success, a technical success, and a regulatory failure."

Barbier declined to provide a target for when simufilam might receive FDA approval, though he did say Cassava will not follow the accelerated approval path recently used by Biogen Inc. The Massachusetts-based biopharmaceutical company received conditional FDA approval in June for its Alzheimer's drug Aduhelm, against the recommendation of an independent board that had expressed concerns its efficacy.

“What Biogen got was a conditional approval. What’s the condition? That Biogen shows that the drug actually works," Barbier said. “We have no interest in a conditional approval. We want full approval.”

Ultimately, Engelsgjerd remains cautious about any drug trial that is not a controlled study. But he is intrigued by Cassava's latest data.

"I think it’s based on what appears to be a clean safety profile and some intriguing early biomarker and cognition readouts," he said. "I think it certainly justifies the plan to do the definitive experiment, but I think it’s hard to compare this dataset to Biogen’s at this point.”

Comments

Post a Comment